Fourth Quarter Report for 2018

Fourth Quarter Report for 2018

The 4th Qtr for 2018 was tumultuous to say the least with varying results across the road transport, automotive, plant and equipment sectors.

The new truck market finished 2018 up with record truck sales in all categories, which is fantastic news for the sector. The used truck market also performed very strongly all around the country throughout 2018. The most interesting yet concerning trend in the 4th Qtr however was these record sales figures plummeted in December and have carried through in to the new year in both the new and used market sectors. We will be watching this closely over the current quarter to determine whether there are larger underlying issues.

The earthmoving, plant and equipment market remained strong over the 4th Qtr with limited stock being offered on to the market and any quality equipment selling well. In the auto sector new car sales saw an overall decline across the board with SUVs and light commercials the only two market segments to buck the trend.

The quarter in short:

- Slattery Asset Advisory saw a significant increase in requests for valuations, particularly in the insolvency space.

- The Road Transport sector has seen a noticeable pullback in market confidence across the road transport sector in both the new and used markets nationally.

- In the Mining and Earthmoving sector, most brands had a strong quarter. Caterpillar 4th Qtr sales and revenues were US$14.3 billion, up 11% from last year

- Quarter four for the automotive market saw sluggish overall sales numbers for new cars in Australia with the overall sales for the year finishing 3% down on 2017.

- Currently, the agri sector is experiencing extreme challenges on the East coast of Australia whilst in the West there has been a bumper season, which has led to an increase in demand for agri equipment there.

Slattery Asset Advisory

Key Point Summary

The December quarter saw a significant increase in requests for valuations, particularly in the insolvency space. This included large jobs in the Energy, Mining and Resources sectors with a reasonable split across all states. We are expecting this to continue with a strong pipeline of requests building for the new quarter.

Following the success of the October Valuations Conference, the 2019 conference dates have now been locked in for 17th & 18th of October 2019. Early bird registrations are already being received so lock the dates in your diary and register early. You can register here

The Asset Advisory Collections business has been fully operational now for some months and going through rapid expansion. For more information on how Asset Advisory Collections can help your business manage the asset recovery process go to www.slatteryassetadvisory.com.au

Road Transport

Key Point Summary

Over the fourth quarter, there has been a noticeable pullback in market confidence across the road transport sector in both the new and used sectors nationally. Whilst there is no clearly identifiable explanation as to the cause of this rapid loss of confidence, anecdotal feedback suggests some road transport operators are becoming wary that the booming market conditions experienced throughout the rest of the year may be starting to wind down. It has also been suggested that the upcoming election and the proposal by Labor to reinstate the Road Safety Remuneration Tribunal is a cause for operators holding off any major capital expenditure decisions until the outcome of the election is known.

We also saw lower numbers and reduced quality of stock in the market throughout the last quarter, which resulted in less interest from buyers avoiding outlaying capital over the Christmas period.

New Truck Market

According to VFACTS, 2018 has been a record year for new truck sales with 41,426 units across heavy, medium, light trucks and vans sold in total representing a 12% increase on the 2017 year. The month of December was a notable outlier with a significant drop on sales figures for previous months We observed sales tapering off in the fourth quarter 2018, with the Truck Industry Council’s (TIC) T-Mark figures show sales of 10,963 vehicles.

New truck sales in the heavy duty segment also hit a new record with an end of year total of 14,344 units sold surpassing the pre-GFC 2007 peak of 13,342, by 1,002 units or 7.0%. The significance of this number is highlighted when comparing year on year sales from 2017, which totalled only 12,002 units representing whopping annual growth of 19.5% for the year.

The medium-duty truck segment also saw solid growth in 2018 with new truck sales. In December we saw 3.9 % growth in truck sales bringing the 2018 total of medium duty trucks to 8,210 units sold, which eclipsed the 2017 total by 12.3 %. Meanwhile, the light-duty truck market delivered a total of 11,628 units, this broke the previous record set in 2017 with a 12.9 % rise.

As a result of the increase in new truck sales, there is more second-hand stock on the market and greater choice for those seeking to purchase second hand units.

Used Heavy Truck Market

Similar to new truck sales, we have seen a significant pullback nationally in used Prime Mover sales from December onwards. Prior to this rapid drop in demand, we saw some very strong sales in QLD in our November auction for late model Kenworth, Mack & Volvo prime movers. These included 4x 2016 Volvo FH16 Prime Movers selling between $175,000 and $180,000, achieving 100% of retail. A 2017 Mack CMHT with 282,513 kms also sold at this auction for $150,000, along with a 2017 Mack Trident CMHT with 288,586 kms for $157,500.

Older Prime Mover and second tier makes are proving more difficult to sell, as buyers are becoming more selective in a softening market.

The VIC and NSW markets saw similar trends to QLD for prime movers over the 4th quarter with demand for good quality, late model and well serviced vehicles able to attract a competitive buyer market prior to December.

Victoria had some standout results over the last quarter for trucks fitted with an Agitator and trucks that are suited to having an agitator mounted. The sale of a well serviced 2008 Kenworth T408 SAR 6×4 Prime Mover, which was intended to be converted achieved $79,500 at auction representing 94% of retail. We also saw the sale of a 2008 Kenworth T358 8×4 Agitator in our VIC November auction achieve $125,500 at auction which is 97% of the retail value.

In NSW there has been a cooling off in prices for tipper truck and dog trailers over the quarter. This is evidenced by the sale of a 2013 Hercules HEDT-3 Tri Axle Dog Trailer, which failed to get a bid at the $30,000 mark in our November auction. In previous quarters these tipper trailers would have had strong competition and achieved $35,000.

WA has reported similar market conditions as other states however noted an exception for water carts, which have been consistently achieving very strong results. Many of the water carts sold in WA throughout this quarter were to buyers in QLD and NSW.

The WA market is continuing to see strong demand in this quarter for heavy duty trucks that are predominately tri-drives, which has kept prices at reasonable levels with limited supply being introduced into the market over the quarter.

Used Medium-Duty & Light-Duty Trucks

The market for medium-duty and light-duty trucks has also noticeably softened around the country towards the end of the last quarter with supply increasing considerably and buyers becoming more selective resulting in lower clearance rates. This is in stark contrast to the buoyant conditions experienced earlier in the year. The overall market in NSW has shown that the values dropped during the fourth quarter with sales results for small to medium trucks dropping by 15%. We continue to see dealers having fewer enquiries while stock numbers are rising with many dealers criticising the second and third tier finance companies for not taking risks with their clients.

Notable strong sales early in the quarter included a 2018 Isuzu NLR Tray Truck with 4,400 kms for $30,000 achieving 95% of retail, and a 2002 Hino Ranger R Pantech with 267,844 kms for $115,000 achieving 100% of retail. These strong results reversed later in the quarter with the sale of a 2013 Mitsubishi Fuso Fighter Tipper with 12,000kms receiving a high bid of $53,000. This truck would have sold for above $60,000 at any time earlier in the year. We also saw 2 x 2010 Hino 300 614 4×2 Tippers sell for $19,000 and $20,000 respectively during our November Auctions yet similar tipper trucks were previously reaching sale prices above $24,000 earlier in the year.

Trailers

In QLD demand for late model trailers was strong, with a large fleet of refrigerated Pantechs selling well at our November auction. Highlights of this sale were a 2015 Maxitrans ST3 Refrigerated Pantech A and B Trailers selling for $100,000 and $110,000 respectively, along with a 2015 Vawdrey VBS3 Refrigerated Pantech A and B Trailers for $90,000 and $97,000 respectively.

In WA there is a continuing shortage of low loaders, floats, drop deck trailers with ramps and flat top trailers as investment starts to return to the mining sector increasing demand for these assets, which in turn has underpinned prices for these units.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2010 Hino 500 Water Tanker | 124,517 | $108,250 | 135% | WA |

| 2012 Isuzu FVZ Euro V Water Cart | 31,081 | $217,600 | 121% | WA |

| 2005 Fuso Fighter FN600 270HP 6x4 Water Cart Truck | 79,440 | $59,550 | 100% | VIC |

| 2002 Kenworth T950 6x4 Tipper Truck | 330,258 | $82,300 | 100% | VIC |

| 2015 FTE 45FT Tri- Axle Refrigerated Pantech Trailer | $160,000 | 100% | VIC | |

| 2013 Maxitrans ST3 45FT Refrigerated Pantech Trailer | $116,000 | 100% | VIC | |

| 2016 Maxitrans ST3 36FT Roll Back Tri-Axle Refrigerated Pantech 'A' Trailer | $127,100 | 100% | VIC | |

| 2016 Volvo FH16 Prime Mover | 498,187 | $180,000 | 100% | QLD |

| 2017 Volvo FH16 Prime Mover | 560,762 | $175,000 | 100% | QLD |

| 2015 Mack CLXT Prime Mover | 698,847 | $115,000 | 100% | QLD |

| 2010 UD Nissan PK9 Water Truck | 193,686 | $58,000 | 100% | QLD |

| 2002 Hino Ranger R Pantech | 267,884 | $115,000 | 100% | QLD |

| 2015 Maxitrans ST3 Refrigerated Pantech 'A' Trailer | $100,000 | 100% | QLD | |

| 2015 Maxitrans ST3 Refrigerated Pantech 'B' Trailer | $110,000 | 100% | QLD | |

| 2015 Vawdrey VBS3 Refrigerated Pantech 'A' Trailer | $90,000 | 100% | QLD | |

| 2015 Vawdrey VBS3 Refrigerated Pantech 'B' Trailer | $97,000 | 100% | QLD | |

Mining and Earthmoving

New Equipment Sales

New sales results in this sector were strong across most brands. Caterpillar 4th Qtr sales and revenues were US$14.3 billion, up 11% from last year, with continued growth across all regions and in all 3 primary segments. Total sales for the year were US$54.7 billion up an enormous 20% on 2017. Increased sales for resource industries equipment, construction equipment in North America and higher demand for reciprocating engines to support gas compression applications in North America were all significant drivers of this increase.

The strong results in North America were supported by the Asia/Pacific region, which finished the quarter up 8%, with $3.1 billion in sales.

Sales to resources industries for Caterpillar in the Asia Pacific region increased an incredible 41% on the 4th Qtr of 2017. Higher demand was attributed to mining as well as heavy construction equipment, including quarry and aggregate. Caterpillar noted that mining activities were robust as market fundamentals remained positive and non-residential construction activities drove higher sales.

These positive results show the continued dominance by Caterpillar in the mining and resource sectors. It also demonstrates that the demand for new equipment is strong across all main segments for Cat

Used Equipment Sales

The 4th Qtr continued the strong trend from previous quarters in the mining and earthmoving equipment market. Good quality earthmoving equipment has consistently attracted high interest and resulted in strong sales across the country with the exception of NSW. There also has been a noticeable undersupply of equipment through all of our offices contributing to the higher sales results.

The Slattery December auction in QLD included the sale of 4 x 2014 K-Tec 1233 Scrapers, which between $152,500 and $175,000 and achieving 90% and 100% of retail. While newer and high-quality assets continue to have strong results, we are seeing older equipment in the market soften. The notable demand in the QLD market has resulted from the infrastructure projects across the east coast of Australia including the Bruce Highway upgrade, M1 Pacific Motorway upgrade and the second Toowoomba Range Crossing.

Our Victorian team have reported a continued strengthening in the market over the past twelve months, with the sale of 3 larger excavators at auction over the past quarter evidencing this trend. Each of these machines resulted in achieving more than 80% of retail value whereas similar machines were previously only reaching 70% of the retail value.

NSW appeared to deviate from the rest of the country during the 4th quarter with slightly lower than expected results. While this departure from the national trend was not severe and it is yet to be seen if it is simply an anomaly in NSW, we do expect strength to return to the market in the current quarter. The challenging market was noticeable during our October auction where we sold 2x excavators – a 2017 Kobleco SK210LC-10 Excavator showing 950 hours which sold for $170,000 and a 2017 Kobelco SK135SR-3 Excavator with 1,600 hours showing that sold for $135,000. These assets had extensive buyer interest during the auction however the returns on the machines were $10,000 or approximately 5% lower than what we had expected to reach.

Across the WA market there has been a decrease in the numbers of large civil and mining assets as operators continue to report high utilisation rates for equipment in the current market, Buyers in WA are only looking to purchase good quality low hour machines with many concerned about the continuity of the recent increase in work across the state. Over the quarter we saw many skid steers achieve strong prices at our WA auctions with many of these units being sold to buyers in the eastern states.

Throughout each quarter specific asset types will experience significant swings in value depending on supply volumes. Early in the quarter, we saw a notable shortage of Water Carts which have been in strong demand due to increased infrastructure and mining contracts in the market. This led to assets achieving 3 times the expected sales price. Later in the quarter, there was a noticeable increase in enquiries for the purchase of CAT Graders and 40T Artic Dump Trucks. Supporting the increasing demand for particular road work and mining assets.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2015 Case IH 600 Quadtrac Tractor | 4,163 Hours | $225,000 | 125% | QLD |

| 2013 Komatsu PC-88MR Excavator | 907 Hours | $86,600 | 102% | WA |

| 2014 K-Tec 1233 Tow Behind Scraper | $175,000 | 100% | QLD | |

| 2013 JCB 3CXeCO Backhoe Loader | 3,764 Hours | $53,000 | 100% | QLD |

| 2007 Kubota U15-3 Rubber Tracked Excavator | 1,791 Hours | $19,000 | 100% | QLD |

| 2017 ASV RT-60 Skid Steer | 153 Hours | $74,693 | 99% | WA |

| 2015 CASE 1356 Excavator | 6,329 Hours | $47,100 | 90% | VIC |

| 2015 Toomey ALG 4500 Tow Behind Scraper | $86,000 | 90% | QLD | |

| 1988 Caterpillar D7H Crawler Tractor | 6,286 Hours | $100,000 | 90% | QLD |

| 2013 Caterpillar 246C Rubber Tyred Skid Steer | 1,348 Hours | $40,000 | 90% | QLD |

| 2012 Hitachi 350H 35T Steel Tracked Excavator | 8,561 | $73,000 | 86% | VIC |

Motor Vehicles

New Motor Vehicles Sales

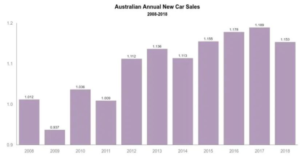

The 4th Qtr continued the sluggish sales numbers for new cars in Australia with the overall sales for the year finishing 3% down on 2017. All market segments except for the powering SUV market saw a reduction in new car sales. The premium new car market took the greatest hit potentially reflecting tightening consumer spending on luxury goods.

Toyota once again took out first-place for the total number of sales by rounding out its year with 217,061 total units sold. This is 0.2% increase more over their 2017 figure followed by Mazda, Hyundai and Mitsubishi.

Passenger new car sales continued to stay down throughout the fourth quarter, while sales for SUV’s continue to grow. Light commercial vehicles in both the new and used market held strong through the quarter. The top vehicle models for the quarter were the Toyota Hilux and Ford Ranger which took out first and second place respectively for the highest sales.

Premium cars in the new car market continued to slide throughout the quarter, with Audi’s sales down 11.8%, Land Rover down 23.1%, BMW down 2.4% and Mercedes-Benz down 13.1% for 2018.

While the car market continues to stand strong, a financial analysis of the market has predicted the falling property prices in Australia could have devastating impacts on new car sales. Analysis of the market has shown that if there is a 10% drop in house prices that could correlate to a 10% drop in new car purchases with the highest impact on passenger vehicles.

Used Motor Vehicle Sales

There have been similar trends to the above across the pre-owned market with all but SUVs experiencing challenging sales conditions. SUV’s, however, continue to perform well in the 4th Qtr while the passenger segment continues to show a decline in values. The strong demand for utilities in the secondary market also continues with dual cab automatic 4×4 diesel vehicles seen as the most popular.

From a brand perspective and reflecting the trend in new car sales, Toyota dominates as the make of choice for wholesalers and all Toyota models in good condition tend to bring a premium. The Toyota Hilux, in particular, continues to maintain extraordinary value in the secondary market closely followed by Prado and Landcruiser. This has been supported by our auction results across the country with 2015 Toyota Hilux SR5 Dual cab reaching 100% of retail selling for $43,000 and a 2015 Toyota Landcruiser GXL Dual Cab 4×4 selling for 64,001 which is 93% of retail.

In QLD vehicles with high kilometres that require extensive work or repairs are attracting very little competition in the auction market. Instead, in the wholesale market dealer buyers are seeking to purchase vehicles that can be on the road quickly as many dealers are aiming for fast turn over to maintain cashflows.

A Victorian car dealer has reported anecdotally that he has witnessed a market drop of up to 15% in used car sales in the industry potentially reflecting the slowdown in the new car market. The results from our auctions in Vic over the same period show older base model Commodore Evoke and Cruze are not very popular in the marketplace with both dealer and end users avoiding them. Evidently, the Holden Cruze has been significantly impacted by the Takata airbag recalls with many Holden dealerships and local service centres advising the replacement airbags will not be in stock for the 2013 model and upwards until August 2019. Dealers do not want this stock on their books tying up capital.

Recent auction results at the end of last quarter saw a lack of quality stock in the market towards the end of 2018, which led to several dealers and end users prepared to pay premiums in preparation to stockyards for the new year break.

In WA we continue to see vehicles in the secondary market beyond 10 years of age slide in price. For these vehicles, maintaining the registration is vital to ensuring the salability. Older unregistered vehicles are achieving prices at auction for parts and scrap value.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2015 Nissan Patrol | 58,696 | $61,350 | 102% | WA |

| 2015 Toyota Hilux SR5 (4x4) | 52,283 | $43,000 | 100% | VIC |

| 2017 Mitsubishi Triton GLS (4x4) | 22,142 | $30,700 | 97% | VIC |

| 2016 Mitsubishi Triton GLX (4x4) | 76,001 | $22,710 | 96% | QLD |

| 2017 Mazda BT-50 Xtr (4x4) | 7,575 | $38,609 | 96% | QLD |

| 2016 Holden Commodore SS-V VF | 19,803 | $38,000 | 95% | VIC |

| 2015 Toyota Landcruiser FXL (4x4) | 31,606 | $64,001 | 93% | QLD |

| 2016 Toyota Hilux SR5 (4x4) | 57,130 | $39,700 | 92% | QLD |

| 2011 Toyota Landcruiser Prado | 115,208 | $33,184 | 92% | WA |

| 2016 Range Rover Sport | 49,051 | $124,800 | 90% | VIC |

Agriculture

Key Point Summary

The sale of agricultural assets is naturally tied quite closely to the health of the wider agri sector at any point in time and the agri sector in Australia often experiences quite different conditions depending on the region. Currently, the agri sector is experiencing extreme challenges on the East coast of Australia with enduring drought conditions for most of NSW and areas of Qld while far North Qld is recovering from flooding. In contrast, Western Australian grain farmers are experiencing a record season and positive conditions.

The demand for agri assets reflects these conditions with most on the east coast holding back from capital expenditure whilst demand has spiked from Western Australia as farmers seek to invest in new equipment, particularly trucks and grain spec trailers. Each of our offices on the East coast have reported increased enquiries out of Western Australia despite not having large volumes of agri assets to sell.

Limited stock came through our auctions this quarter. A highlight being in our QLD December auction where we sold a 2015 Case IH 600 Quadtrac Tractor with 4,163 hours for $225,000, achieving 125% of retail

During the current quarter, we have a number of late model John Deere tractors for sale and will be in a position to report back in the next quarter on the market response.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2015 Case IH 600 Quadtrac Tractor | 4,163 hours | $225,000 | 125% | QLD |

Leave it with us

We are Asia Pacific’s most dynamic and trusted partner in Asset Advisory. Our hands-on approach answers every client brief with a tailor-made solution.

| Directors | Network | |||

|---|---|---|---|---|

| James Slattery 0439 929 616 [email protected] | NSW/ACT Bruce Teichert 0499 000 813 [email protected] | |||

| Paddy Slattery 0412 402 264 [email protected] | VIC/TAS Ben Hibell 0422 955 206 [email protected] | |||

| Tim Slattery 0407 901 070 [email protected] | QLD/NT James Rouse 0484 555 665 [email protected] | |||

| Bruce Teichert 0499 000 813 [email protected] | QLD/NT Anthony Martin 0427 483 165 [email protected] | |||

| WA Steve Waterman 0407 777 893 [email protected] | ||||