Fourth Quarter Report for 2019

The fourth quarter of 2019 saw a decline across all key market sectors, particularly road transport and automotive suffering the largest decline. The quarter, in short, can be found here:

- All truck segments suffered a decline in sales throughout 2019, with the end of year sales results ending with an 8.8% decline in comparison to the 2018 end of year results.

- We continue to see European trucks gaining more traction in the market, with these units being reported to have additional driver aids, reduced emissions and a good fuel economy.

- Caterpillar Inc, has reported that sales and revenue have fallen 8% in the fourth quarter.

- We continue to see the drought affecting large areas of regional Queensland and New South Wales, this has led to a continued downward effect on agricultural equipment in both the new and secondary markets.

- We saw a 7.8% decline on new car sales across Australia, making it the worst year on record since 2011.

- We saw stronger results in the secondary car market throughout the fourth quarter, as wholesalers and dealers are seeing a slow supply of second-hand cars on the market-leading to an increase in demand.

Slattery Asset Advisory

Following on from a busy third quarter Valuations were noticeably quieter in Q4 as Bank lending activity shifted down a gear, resulting in a reduction in volumes on the previous quarter by roughly 40%.

Asset categories remain reasonably consistent with previous quarters with heavy transport dominating (and increasing), now accounting for around 39% of all valuations by value and 43% by number, closely followed by general Plant and Equipment.

With the new year now in place, we welcome our new General Manager, Valuations Brendon Crabtree. This is an expansion of the team in line with the growth over the last two years and reflects the ongoing importance of Valuations to the overall business. Brendon brings with him a wealth of experience and will no doubt take the business to new levels.

Road Transport

New Road Transport Market

Truck sales throughout 2019 decreased by 8.8% with a total of 37,960 units sold in comparison to the previous year results in 2018, which currently holds the record for new truck sales.

Latest sale results from the Truck Industry Council have all truck segments across the country suffering a decline in sales throughout 2019, with the light duty category seeing the highest decrease of 12.5%, followed by the heavy duty segment with a decrease of 11.2% and the medium duty segment down 9.7%. The only segment to see an increase in sales throughout 2019 was the light-duty van segment, which grew by 6.5%.

Heavy Duty Truck Market

The fourth quarter has continued to see the heavy duty truck segment struggle, with declining sales across all three months. Throughout November, the heavy-duty market saw a total of 1,031 units sold, this is down 26.3% for the same period in 2018. December saw a 5.9% decline in sales over 2018 results with 1,116 new units sold.

Kenworth continued to be the leading brand in the fourth quarter for the heavy-duty segment, with a total of 2,350 units sold year to date, this has been a decrease of 20.2% in comparison to Kenworth’s sales in 2018. Volvo came in second with 2,239 units sold year to date and rounding out the top three was Isuzu with a total of 1,518 units sold year to date. In this market, we continue to see the European trucks gaining more traction, as these units are reported to have additional driver aids, reduced emissions and a good fuel economy.

Tony McMullan, the CEO of the Truck Industry Council, made a comment that all truck segments have been struggling for sales at a time of year where sales are typically strong, as many operators should have been bulking up for the festive season demands.

Medium & Light Duty Truck Market

The medium and light duty segments followed the same trends as the heavy-duty market with declining sales during the fourth quarter.

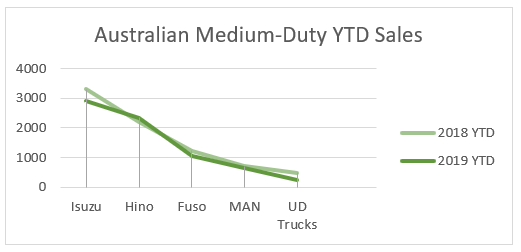

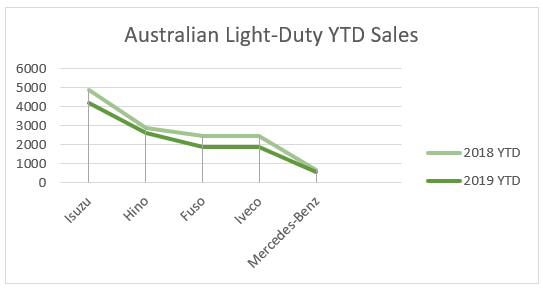

November saw the downward trend continue with 584 new units sold for the month, this is a 17.8% decline on the previous year and December saw this figure decline to 560 units sold, bringing it to a 19.2% drop on figures from December 2018. The total medium duty segment recorded 7,411 units sold across the year with is a decrease of 9.7% on the 2018 results.

Japanese brands continue to be the best sellers in the medium duty segment, with Isuzu taking the lead with a total of 2,896 units sold in 2019, this is down 12.4% from the previous year. Hino comes in at a close second with 2,339 units sold across the calendar year. In the medium duty segment, Hino is the only brand to report a sales growth of 7%.

The light duty segment in November did not see any improvement in this segment with sales down 18% over November 2018, with a total of 946 units sold. December continued this downward trend, with 1,044 units sold, down 12.1% on the previous year results. Year to date, the total light duty segment sales declined by 12.5% on the 2018 year to date results, with a total of 11,487 units sold.

The light duty segment continued to see the Isuzu outperform the other brands with a number of units sold, followed by Hino and Fuso.

Secondary Road Transport Market

Across the country, we continue to see similar results on the secondary market as we did in the new road transport segment, specifically the New South Wales market took the biggest hit in the fourth quarter. Twelve months ago, New South Wales was seeing strong auction prices for the tipper and dog trailer market, whereas during the fourth quarter, it was hard to get a reasonable offer on an asset that was over five years old. This can be seen in the sale of a 2004 Mack Trident 6×4 Tipper and 2004 Borcat Super Dog Trailer that was sold as a set in the November Truck & Machinery Auction in Hexham, which only received a high bid of $29,000. Previously, this lot would have likely sold for approximately $55k or more. Another example is the sale of 2 x 2004 Mack Fleetliner 6×4 tippers and 2004 Hamelex Super Dog Tipper Trailers that failed to receive a bid at $20k for each sold as a set in the same November auction. These sets would have likely made $45K, just twelve months prior.

The significant deterioration within this last quarter was not just consigned to the large tipper truck and trailer market. October saw 7 x 2012 Hino 300 617 tippers offered with results ranging within the $18k to $23.5k range. There was also 4 x 2011 Hino 300 617 tippers offered for the same local council vendor that all made between $18k to $19k over the previous 5 years, these small to medium sized Japanese commercial trucks have always been in good demand and held their value, particularly for council assets. The above results represent approximately a 35% decrease in sales value compared to 18 months ago.

Throughout the fourth quarter, we continued to see aged trucks and trailers perform poorly. In Western Australia, it has been reported that many used truck dealers are overstocked with aged units and many consumers looking to purchase newer units as they have better safety standards and better fuel economy standards.

The Queensland market saw improved auction results in the fourth quarter for the road transport sector. These results drove stronger prices and auction clearance rates during November and December. This can be seen is the sale of a 2018 Kenworth K200 Prime Mover with 252,357 kms showing, selling for $253,000 and achieving 95% of retail value and a 2012 Kenworth C509 Prime mover with 1,205,409 kms showing, selling for $116,000 and achieved 100% of retail value. The Queensland team continue to see Volvo and Kenworth trucks continue to perform well at auction, with consumers looking to spend more on these units.

Victoria followed the same trend as Queensland in the fourth quarter, with more positive results being achieved at auction, we saw buyers chasing late model European prime movers, especially if they are an automatic and willing to pay a premium for these units.

Smaller tippers and trays such as Hino and Isuzu are still in high demand in the Victorian market, with buyers willing to pay a premium for assets with a good service history.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2012 Kenworth C509 Prime Mover | 1,205,409 | $116,000 | 100% | QLD |

| 2004 Isuzu FVR Series Tipper | 195,847 | $55,000 | 100% | QLD |

| 2010 Western Star 4800FX | 722,429 | $63,104 | 97% | VIC |

| 2018 Kenworth K200 Prime Mover | 252,357 | $253,000 | 95% | QLD |

| 2018 Hino FM 500 Tipper | 27,407 | $120,000 | 95% | QLD |

| 2018 Isuzu NPR Series Tray Back | 9,410 | $37,000 | 95% | QLD |

| 2012 Mack Superliner | 924,530 | $76,200 | 95% | WA |

| 2009 Isuzu FXZ1500 | 199,294 | $105,000 | 92% | WA |

| 2008 Volvo FM440 Tipper | 250,011 | $55,488 | 92% | VIC |

| 2013 Euro Cargo Tilt Tray | 174,924 | $67,500 | 90% | WA |

| 2013 Volvo FM370 Tipper | 344,228 | $65,280 | 87% | VIC |

Mining and Earthmoving

New Earthmoving & Mining Market

The Caterpillar Quarter 4 results for 2019 were down. Fourth-quarter sales and revenues down 8%; full-year sales and revenues decreased 2%. In the Asia Pacific region sales in construction equipment was flat while sales to the resources sector dropped 23% in the same period in 2018. In more positive news, energy and transportation were up 26%.

Chairman and CEO Jum Umpleby commented on the outlook for 2020. ‘We expect continued global economic uncertainty to pressure sales to users in 2020 and cause dealers to further reduce inventories. We have improved our lead times and remain prepared to respond quickly to any positive or negative changes in customer demand.’

Caterpillar noted that while commodity prices are generally supportive of reinvestment, Caterpillar continues to believe mining customers remained disciplined in their capital expenditures due to economic uncertainty, resulting in lower sales in the quarter. In addition, end-user demand decreased for equipment supporting non-residential construction.

Secondary Earthmoving & Mining Market

The secondary earthmoving and mining market has performed similarly to the road transport market across the country throughout the fourth quarter. In Western Australia, we are seeing aged equipment in this market continue to have a limited audience, which is reflected in the auction results as consumers are not interested in lengthy or costly repairs on aged equipment. In November we were appointed to a liquidation of a concrete piling and drilling business, this auction saw strong results and demand for the equipment. This is an indication that the exploration sector within Western Australia is currently active. An example of this 2008 Soilmec PSM-8 Micro Drill Rig selling for $53,200 which is 106% of retail.

Within Victoria, we continue to see strong demand for quality earthmoving assets at auction, this is predominately due to the significant number of infrastructure projects that are ongoing within the rail and road sectors within the state including the Westgate tunnel project and the level crossing removal projects. There has also been a strong demand for smaller assets within the secondary market, specifically skid steers and kanga loaders that are well serviced and maintained as shown in.

Within Victoria, we continue to see strong demand for quality earthmoving assets at auction, this is predominately due to the significant number of infrastructure projects that are ongoing within the rail and road sectors within the state including the Westgate tunnel project and the level crossing removal projects. There has also been a strong demand for smaller assets within the secondary market, specifically skid steers and kanga loaders that are well serviced and maintained as shown in.

Hexham offered some good quality Caterpillar D6 ‘swampy’ dozers as well as 2 caterpillar scrapers in an online auction in late November. One observation that came through from this auction was the difference in price between swamp dozers and normal D6 dozers. Swamp dozers are specifically designed to work in wet, soft and unstable conditions and have wider tracks to handle this environment. Given the drought and lack of wet conditions, the difference in prices demanded for swamp dozers compared to normal Caterpillar D6 dozers is substantial.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2008 Soilmec PSM-8 Micro Drill Rig | 2,729 | $53,250 | 106% | WA |

| 2013 Jacon Mobile Concrete Pump | 1.107 | $36,700 | 105% | WA |

| 2017 Caterpillar D6T XL Crawler Tractor | 3,134 | $325,000 | 100% | QLD |

| 2017 Yanmar V1055-6B Tracked Excavator | 1,850 | $56,000 | 100% | QLD |

| 2006 Caterpillar D6R XL Crawler Tractor | 20,500 | $120,000 | 100% | QLD |

| 2017 Toyota Huski 30-5SDK8 Skid Steer Loader | 327 | $31,000 | 95% | QLD |

| 2007 Caterpillar 12H Grader | 11,838 | $100,000 | 95% | QLD |

| 2012 Kobelco SK235SR Excavator | 6,299 | $60,000 | 92% | WA |

| Case Tracked Excavator | 2,700 | $110,976 | 91% | VIC |

| Hitachi Tracked Excavator | 4,532.9 | $15,776 | 90% | VIC |

Agriculture

Over the fourth quarter we continued to see the drought still affecting large areas of regional Queensland and New South Wales, this has led to the continued downward effect on agricultural equipment in both the new and secondary equipment market, with slower than normal machinery sales across all facets of agriculture from farming equipment to processing and even water storage including bore and dams.

Agricultural tractors have suffered another decline in the fourth quarter of 2019 with sales down 16% in comparison to November 2018 results, however, there was an increase of 7.5% across the entire market in December in comparison to December 2018. The overall market saw the year ending with a 9% decline in sales in comparison to the 2018-year results. The picture for the New South Wales market continues to be disheartening, with it suffering a 28% decline in sales in November and a 12% fall in December, which left the state trailing behind the previous year’s result with a 20% decrease in sales, with the severe drought, water shortages and bushfires having a devastating effect on the agriculture industry across the state.

In Queensland, there are approximately 30,500 businesses that carry out agricultural activity, which contributes more than $10 billion to the state’s economy each year. With this industry struggling, despite government stimulus packages for farmers in drought-affected area, the general spend on new machinery and equipment was below expectation in the fourth quarter across the state. November saw sales in Queensland fall another 19% and an increase of 6% throughout December, this has left them trailing 2018 results by 7% overall. The expectation is if the rain continues to fall and reach drought-affected properties then machinery sales and equipment will begin to bounce back in the mid-2020 months.

Activity in the agricultural sector has remained steady within the fourth quarter, with November results in line with previous year’s results and December finishing the year strong for the state with a 22% increase in sales in comparison to the previous years. The overall tally for Victoria, saw sales remain the same throughout 2018 and 2019. The Western Australian market took a massive dip in sales throughout November with a 35% drop on the previous year’s results. This came as shock to the market, as the state had been reporting an increase in new equipment throughout the rest of the year. December saw sales finishing in line with their previous year’s results but left the state 6% down in sales for 2019 overall.

Activity in the agricultural sector has remained steady within the fourth quarter, with November results in line with previous year’s results and December finishing the year strong for the state with a 22% increase in sales in comparison to the previous years. The overall tally for Victoria, saw sales remain the same throughout 2018 and 2019. The Western Australian market took a massive dip in sales throughout November with a 35% drop on the previous year’s results. This came as shock to the market, as the state had been reporting an increase in new equipment throughout the rest of the year. December saw sales finishing in line with their previous year’s results but left the state 6% down in sales for 2019 overall.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2015 Reform Mounty 100V 4x4 Tractor | 758 Hours | $41,000 | 95% | QLD |

| 1996 John Deere 6600 4x4 Tractor | 2,223 Hours | $13,000 | 95% | QLD |

| 2012 John Deere 6330 4x4 Tractor | 2,457 Hours | $35,000 | 90% | QLD |

| Flip Screen L-150 | $8,737 | 87% | VIC | |

Motor Vehicles

The closure of Holden & the impact on the market

The beloved Australian car is now dead or dying at least. The announcement by General Motors to cease all Holden operations as the company is no longer economically viable has sent waves through the Australian automotive and political camps. With 800 workers set to lose their jobs.

But if you think Australia is completely out of the automotive business, then you are very much mistaken.

According to industry analysts IBISWorld, Australian automotive manufacturing generated $4.1 billion of revenue last financial year, with 388 businesses operating across 466 workplaces employing nearly 7,500 people.

The same report also highlights the blow from the mass car producers pulling out of the market — revenue is down by almost two-thirds over the past decade, with the bulk of that fall occurring since the big three remaining local car makers (Ford, Holden and Toyota) ceased Australian production during 2016 and 2017.

Australia’s auto sector is still expected to generate more than $3.2 billion in revenue in 2023-24, with 301 businesses employing almost 4,400 people.

So what is left and what industry is going to generate this revenue? The biggest part of the answer is trucks and buses, which respectively make up 54 and 14 per cent of the remaining auto industry in Australia.

While Australia now imports virtually all its cars, the nation still has three significant truck factories owned by multinational giants Volvo, PACCAR (Kenworth) and CNH Industrial (Iveco Truck & Bus), which between them have close to 50 per cent market share.

New Car Market

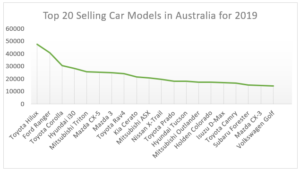

The new car market in Australia throughout 2019 has shown some worrying signs, with the overall tally of new car sales declining 7.8% on 2018 figures, making it the worst year since 2011. This can be seen in the December 2019 results, which saw a decrease of 3.8% in figures in comparison to December 2018 results. The Federal Chamber of Automotive Industries has reported that 1,062,867 new vehicles were sold overall in 2019, this is a decline of 90,000 sales compared to 2018 figures.

We have continued to see Toyota top all other brands throughout 2019 with a total of 205,766 new vehicles sold. However, this is a 5.2% decline from the previous year’s total sales. Mazda came in second place with 97,619 cars sold but once again, we saw a 12.3% drop in sales and lastly, Hyundai came in at third place with 86,104 sales, with an overall 8.6% drop in new car sales throughout 2019. On a positive note for 2019, there has been a 54% increase in sales for petrol-electric hybrid cars in 2019, with a total of 30,641 sales.

Overall, the decline in sales throughout the year have been affected by an election, tightening bank lending criteria, slow wage growth, low consumer confidence, fluctuating currencies and extreme weather conditions. This affects new car sales as they are being driven by private buyers who are still cautious despite record low-interest rates as Westpac data shows consumer confidence has hit a four-year low. Fleet and government buyers are spurring figures on however still we have seen an 8.7% decrease in business sales, a 4.5% decrease in rental fleets and a 5.9% decrease in government sales.

Secondary Car Market

The trend in the secondary car market results has been stronger than the new car market throughout the fourth quarter, as wholesalers and dealers are seeing a slow supply of second-hand cars on the market-leading to an increase in demand.

The trend in the secondary car market results has been stronger than the new car market throughout the fourth quarter, as wholesalers and dealers are seeing a slow supply of second-hand cars on the market-leading to an increase in demand.

Western Australia has reported that second-hand car dealers have had good stock turn over during the fourth quarter, but their margins are slimming. This is the effect of buyers becoming increasingly better educated, due to the availability of information on the internet. This is driving demand for secondary cars within the market, which has seen auction clearance rates sitting consistently around 85% throughout the state. The standout for the quarter for our Perth team was the sale of a 2005 Ford F250 with 183,477 kms, selling for $58,750 and achieving 98% of retail value.

Throughout the fourth quarter, we have seen a strong demand for good quality, late model cars at auction in New South Wales. This increase in demand has been related to the Christmas period, with many dealers looking to increase stock level over the holiday season, with this period becoming a busy season for second-hand car dealers. With auction clearance rates in New South Wales averaging out at 80% for the quarter.

The standouts for the quarter was the sale of a 2018 Ferrari 488 Spider in Sydney with 21,762 kms, that sold for $356,200 at auction which made 89% of retail value, a 2015 Jaguar XF R-Sport in Perth with 54,140 kms selling for $37,750 and achieving 94% of retail value and lastly a 2015 Porsche Macan S Wagon in Brisbane which had 125,627 kms showing, sold for $48,250 and achieved 95% of retail value. We continue to see unique and performance vehicles perform well, due to the low volumes of trades on these vehicles and the lack of them in the secondary market.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2016 Holden Commodore SS-V Redline | 25.474 | $42,500 | 100% | QLD |

| 2001 Custom Built AC Cobra Roadster Replica | 39,002 | $39,500 | 100% | QLD |

| 2018 Toyota Hilux | 18,901 | $44,184 | 100% | VIC |

| 2005 Ford F250 | 183,477 | $58,750 | 98% | WA |

| 2017 Hyundai Tuscon | 33,356 | $22,480 | 96% | WA |

| 2018 Honda CBR500R Motorcycle | 2,032 | $5,800 | 96% | NSW |

| 2016 Ford Ranger Wildtrack | 76,259 | $38,300 | 95% | QLD |

| 2018 Audi Q2 | 17,071 | $28,500 | 95% | QLD |

| 2015 Porsche Macan S | 125,627 | $48,250 | 95% | QLD |

| 2015 Jaguar XF R-Sport | 54,140 | $37,750 | 94% | WA |

| 2015 Toyota Rav-4 | 69,040 | $17,335 | 94% | VIC |

| 2016 Isuzu D-Max | 33,714 | $27,228 | 94% | VIC |

| 2018 Volkswagen Caddy | 1,044 | $23,000 | 92% | WA |

| 2017 BMW M2 | 20,944 | $64,250 | 91% | NSW |

| 2014 Toyota Landcruiser GXL | 58,494 | $51,000 | 90% | QLD |

| 2018 Ferrari 488 | 21,762 | $356,200 | 89% | NSW |