Quarterly Asset Remarketing Report - Q4 2020

- New road transport sector achieved 5 months of growth and is showing some certainty for strengthening results in 2021 across all segments.

- Positive growth was recorded in the fourth quarter for new road transport market.

- Caterpillar has seen full-year sales and revenues decline by 22% in 2020. One of the only positives to be found was in Asia pacific with the Resource industry going up by 8% highlighting that mining was less affected by the COVID-19 pandemic.

- The agricultural equipment market in Australia had a standout year. Highlighted with Tractor sales not seen since the 1980s with over 13,000 units sold in a one month period.

- The Automotive industry is grappling with stock shortages across the country; The VFACTS data shows 916,968 new cars were reported as sold for the 2020 calendar year – down by 13.7 per cent compared to the prior year, but a recovery from the 48.5 per cent decline in April 2020.

- Secondary truck, machinery and automotive assets through auction remained very strong this quarter with stock short for new assets prices achieved were positive.

- Luxury and recreation assets such as motorhomes, sports cars and boats have been popular. This is the result of the COVID-19 pandemic and Australian being unable to travel overseas for holidays, therefore have been purchasing luxury goods to enjoy their holidays at home.

Road Transport

Key Point Summary

- Positive growth was recorded in the fourth quarter for new road transport market;

- Industry experts have indicated sales would have been even higher if supply was able to meet demand;

- New road transport sector achieved 5 months of growth and is showing some certainty for strengthening results in 2021 across all segments;

- Trucks and trailers presented at auction have achieved strong results;

- Lead times for some trailers are extending out to three months in some circumstances; and

- Skel trailers have been the exception, with these assets struggling to sell due to the reduced activity at ports around the country.

New Road Transport Market

Road Transport market in the fourth quarter saw signs of recovery, with positive growth being recorded, made possible by the stabilisation in the truck market during the third quarter.

Reflecting on 2020 the market has faced difficult times, firstly we had COVID-19, which saw many truck manufacturers forced to shut down operations for extended periods of time, domestically and internationally. Secondly, the Australian economy entered a recession, this diverted consumers away from making expensive purchases, until the Government implemented financial stimulus packages to encourage consumers back to help stimulate the economy.

Reflecting on 2020 the market has faced difficult times, firstly we had COVID-19, which saw many truck manufacturers forced to shut down operations for extended periods of time, domestically and internationally. Secondly, the Australian economy entered a recession, this diverted consumers away from making expensive purchases, until the Government implemented financial stimulus packages to encourage consumers back to help stimulate the economy.

Heavy duty truck sales year on year were down in October 2020 by 6.1%, with 66 fewer trucks in this segment being sold to consumers. Medium duty truck sales strengthened in October with 536 trucks delivered, this is down 58 trucks over the same period in 2019, when we saw stronger economic conditions around the country. Sales for the light duty truck market have continued the upward trend, with 934 trucks sold for October 2020, this is an increase of 4 trucks on October 2019 results. Tony McMullen from the Truck Industry Council correlated these results to the ongoing financial benefits being provided by the Federal Government’s instant asset write off program.

Across the three truck segments in November, we continued to see this confidence in the market compared to sales in early 2020. Heavy duty trucks saw a total of 1,032 trucks delivered in November 2020, an increase of one sale compared to sales in November 2019. The medium duty sector saw a total of 562 trucks delivered, a decrease of 3.8% on 2019 results for the same period. As seen in the October 2020 results, the light duty segment continued to be the best performer in November 2020, with 1,015 trucks delivered for the month. This is an increase of 69 trucks delivered for the same period of 2019, or an increase of 7.3%.

Industry experts have indicated sales would have been even higher if supply was able to meet demand. Lag times getting new stock in the market due to manufacturing closures and labour stoppages during COVID-19 left the market short on supply.

Industry experts have indicated sales would have been even higher if supply was able to meet demand. Lag times getting new stock in the market due to manufacturing closures and labour stoppages during COVID-19 left the market short on supply.

December saw exceptional results for the new truck market across Australia with a total of 3,478 units sold, up 230 on the same period in 2019, and closed 2020 with the second best truck sales results on record for the month of December. The heavy-duty segment delivered a total of 1,144 units in December, this is up 28 trucks (2.5%) on the same period in 2019. Medium duty segment delivered a total of 655 trucks, a 17% increase on December 2019. Light Duty segment continued to perform well in December 2020 with a total of 1,069 trucks delivered, this is an increase of 25 trucks over December 2019.

The fourth quarter brought 2020 to a close, with the new road transport sector achieving 5 months of growth and showing some certainty for strengthening results in 2021 across all segments. The Australia Federal Government has announced that the instant asset tax write off stimulus package will run until 2022, with the potential to impact both new and secondary road transport markets positively in 2021.

Secondary Road Transport Market

The secondary road transport market has remained stable in the fourth quarter throughout the country. Trucks and trailers presented at auction have achieved strong results due to the lack of stock and substantial lead times to purchase new trucks and trailers.

The secondary road transport market has remained stable in the fourth quarter throughout the country. Trucks and trailers presented at auction have achieved strong results due to the lack of stock and substantial lead times to purchase new trucks and trailers.

The Sydney market has seen some strong results over the past quarter, including a 2011 Kenworth K200 Prime Mover with 446,000kms selling for $110,000 which represents 95% of retail value and a number of 2015 to 2018 Isuzu commercial trucks achieving between 95% – 100% of retail value. Similar results can be seen in the Queensland market, a 2019 Western Star 4964 Prime Mover showing 126,737 kms selling for $286,000, achieving 100% of retail value and a 2018 Kenworth T409 Prime Mover with 270,315kms selling for $195,000, achieving 90% of retail value.

Similar results can be seen in the Queensland market, a 2019 Western Star 4964 Prime Mover showing 126,737 kms selling for $286,000, achieving 100% of retail value and a 2018 Kenworth T409 Prime Mover with 270,315kms selling for $195,000, achieving 90% of retail value.

Older trucks have been selling well in the fourth quarter, with a 2015 Kenworth T909 showing 931,378 kms selling for $145,000 and achieving 95% of retail value. Prime Movers in the Victorian market have seen a slight improvement in the fourth quarter, with only good quality and late model stock being sought after. This was highlighted in the sale of a 2018 Mack Granite for $40,700, representing 80% of retail value.

Lead times for some trailers are extending out to three months in some circumstances causing secondary market prices for these assets to remain strong during the fourth quarter.  This has been highlighted in the Victorian sales of a 2006 Vawdrey Drop Deck Curtainsider with a rear Mezzanine Deck selling for $45,300, achieving 100% of retail value and 4 x 2018 Cartwright OD Refrigerated Trailers selling for 100% of retail value. Low loaders, curtainsiders, pantechs and refrigerated pantechs have been greatly sought after in the Queensland market, as highlighted in the sale of a 2013 Drake Quad Axle Low Loader which sold for $220,000, achieving 90% of retail value and a 2012 J. Smith & Sons Low Loader selling for $82,000, achieving 100% of retail. Skel trailers have been the exception, with these assets struggling to sell due to the reduced activity at ports around the country.

This has been highlighted in the Victorian sales of a 2006 Vawdrey Drop Deck Curtainsider with a rear Mezzanine Deck selling for $45,300, achieving 100% of retail value and 4 x 2018 Cartwright OD Refrigerated Trailers selling for 100% of retail value. Low loaders, curtainsiders, pantechs and refrigerated pantechs have been greatly sought after in the Queensland market, as highlighted in the sale of a 2013 Drake Quad Axle Low Loader which sold for $220,000, achieving 90% of retail value and a 2012 J. Smith & Sons Low Loader selling for $82,000, achieving 100% of retail. Skel trailers have been the exception, with these assets struggling to sell due to the reduced activity at ports around the country.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2006 Vawdrey Drop Deck Tautliner | 297,843 | $45,300 | 100% | VIC |

| 2018 Cartwright OD Refrigerated Trailer | $120,000 | 100% | VIC | |

| 2019 Western Star 4964 Prime Mover | 126,737, | $286,000 | 100% | QLD |

| 2012 J. Smith & Sons Low Loader | 319,610 | $82,000 | 100% | QLD |

| 2009 Hino 300C Wide Cab 4x2 Tipper | 118,665 | $24,750 | 100% | NSW |

| 2011 Kenworth K200 | 446,000 | $110,000 | 95% | NSW |

| 2018 Isuzu NLR 45-150 AMT Traypack | 10,500 | $39,500 | 95% | NSW |

| 2015 Kenworth T909 Prime Mover | 931,378 | $140,300 | 95% | QLD |

| 2007 Vawdrey Refrigerated Trailer | $49,500 | 95% | WA | |

| 2015 Fuso FM600 with 2015 Ringomatic Cacuum Unit | 143,000 | $104,000 | 90% | NSW |

| 2015 Isuzu FH FRR 500 Tipper Crane & Truck | 170,000 | $45,500 | 90% | NSW |

| 2018 Isuzu NPR65 Service Body Truck | 39,000 | $40,000 | 90% | NSW |

| 2015 Isuzu NPR 45 155 | 85,000 | $31,300 | 90% | NSW |

| 2017 DAF (FAD) CF85 85.510 8x4 Concrete Pump Truck | 25,200 | $490,600 | 90% | NSW |

| 2012 Hino FMIJ 500 (2630) | 360,000 | $71,200 | 90% | NSW |

| 2018 Kenworth T409 SAR Prime Mover | 270,315 | $195,000 | 90% | QLD |

| 2013 Drake Quad Axle Low Loader | $220,000 | 90% | QLD | |

| 2016 Isuzu NPR 45 155 Tradepack 4x2 Tabletop | 142,987 | $29,610 | 90% | NSW |

Mining & Earthmoving

Key Point Summary

- Caterpillar has seen full-year sales and revenues decline 22% in 2020;

- The COVID-19 pandemic cut demand and dealers reducing inventories pulled sales and revenues down steeply in the quarter and year;

- Secondary earthmoving and mining equipment remained stable within the fourth quarter; and

- Queensland has seen machines and second-hand components for mining fleets attracting strong interest.

New Earthmoving & Mining Market

Caterpillar sales and revenues decreased by 15% for the fourth quarter of 2020 compared with the same period in 2019.

Caterpillar sales and revenues decreased by 15% for the fourth quarter of 2020 compared with the same period in 2019.

Full-year sales and revenues were down 22% compared with 2019. The sales decline reflected lower end-user demand and dealers reducing their inventories by $2.9 billion in 2020. With the global shutdown a decrease of this size can be seen as a small success.

The COVID-19 pandemic cut demand causing dealers to reduce inventories, which pulled sales and revenues down steeply in the quarter and year. For other manufacturers in earthmoving and mining equipment sales as a whole were down with the supply of new machines into the market very low causing demand to jump for used earthmoving and mining equipment.

Looking at the Asia Pacific region there was a sales decrease on construction sales of 4%. Primarily due to lower sales volume and unfavourable price realization. The positive signs out of the Asia Pacific region was a sales increase for the Resources Industry of 8%, resulting from Australian mining operations not as affected by the global pandemic as other industries.

It is worth noting that Caterpillar (USA) had to shutdown their facility twice during the pandemic further pushing out lead times on orders, this has consequently seen an increase in prices achieved for used machines at auction.

Secondary Earthmoving & Mining Market

Secondary earthmoving and mining equipment remained stable within the fourth quarter, with strong sale results being achieved at auction. Issues with supply chains for manufacturers have caused delays in delivery time for new machinery, which has created this positive effect in the market, as dealer stock levels across the country are at an all-time low.

Highlights across the country for the civil equipment market included a 2017 DAF with Concrete Boom Pump Truck that sold from our Sydney office, and realised 90% of retail value. In Melbourne, a 2010 CAT 216B Skid Steer Loader was presented at auction, showing 1,620 hours and sold for $23,900, achieving 100% of retail value and a 2016 CASE CX36B Mini Excavator with 1,075 hours showing sold for $39,100 and achieved 89% retail value to a customer who will export the machine to Asia.

Highlights across the country for the civil equipment market included a 2017 DAF with Concrete Boom Pump Truck that sold from our Sydney office, and realised 90% of retail value. In Melbourne, a 2010 CAT 216B Skid Steer Loader was presented at auction, showing 1,620 hours and sold for $23,900, achieving 100% of retail value and a 2016 CASE CX36B Mini Excavator with 1,075 hours showing sold for $39,100 and achieved 89% retail value to a customer who will export the machine to Asia.

In Queensland, the hammer came down on a 2018 Yanmar ViO82 Hydraulic Excavator with 2,050 hours at $94,000, this represents 100% of retail value. The market in Queensland has also seen older equipment with high hours selling well at auction, as highlighted in the sale of a 2005 Caterpillar 140H Grader with 12,718 hours selling for $115,000, achieving around 95% of retail value and a 2012 Caterpillar 325D Hydraulic Excavator with 10,768 hours showing, sold for $75,000 and achieved 90% of retail value.

The secondary mining equipment market in Queensland has seen machines and second-hand components for mining fleets attracting strong interest, as companies look to refurbish assets, rather than replacing them due to reduced capital expenditure budgets and the global disruptions in the supply for new machines due to the pandemic. This has been highlighted in the sale of a 16-year-old ‘parts only’, Caterpillar 793 Dump Truck that sold for almost $500,000 at auction in Nebo, QLD.

Western Australia is experiencing similar strong results in the mining sector and expect demand for civil construction equipment to strengthen over the year ahead with many major development projects and road upgrades underway.

We expect demand for used equipment to remain strong for the year ahead with major earthmoving manufacturers reporting lead times on new 2t–20t machines of 3-4 months with a minimum 20% deposit to be made on all orders when placed. This will ensure those operators seeking equipment quickly to put on jobsites will be actively participating in auctions.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| CAT 216B3 Skid Steer Bobcat | 1620.3 | $23,900 | 100% | VIC |

| 2018 Yanmar ViO82 Hydraulic Excavator | 2,050 | $94,000 | 100% | QLD |

| 2007 Tatra Terrno1 | 56,371 | $70,100 | 98% | WA |

| 1998 Caterpillar D10R | 40,877 | $293,100 | 97% | WA |

| 2013 Hyundai Robex 80CR-9 | 4,158 | $50,500 | 96% | NSW |

| 2005 Caterpillar 140H Motor Grader | 12,712 | $115,000 | 95% | QLD |

| 2012 Caterpillar 324D L Hydraulic Excavator | 10,768 | $75,000 | 90% | QLD |

| 2012 Caterpillar 432E Backhoe Loader | 3,248 | $65,100 | 90% | QLD |

| 2014 Caterpillar 246D Skid Steer Loader | 1,307 | $45,800 | 90% | QLD |

| 2016 Case CX36B Excavator | 1,075 | $39,100 | 89% | VIC |

Agriculture

Key Point Summary

- The agricultural equipment market in Australia had a standout year;

- Manufacturing times have pushed the supply of new equipment out 4 to 12 weeks on sought after makes and models;

- Tractor sales for 2020 have achieved levels not seen since the 1980s with over 13,000 units sold in a one month period;

- Combine Harvesters finished the year off strong with a 25% increase in sales in comparison to 2019; and

- With a lack of stock on the secondary market, buyers are willing to spend more to purchase agricultural equipment.

The agricultural equipment market in Australia had a standout year, with the fourth quarter following the same trend as seen in previous quarters, with record-breaking tractors sales. This has related to good seasonal conditions and the government stimulus package. Moving into 2021, it is expected that equipment sales could slow as issues with the supply of stock continue.

Manufacturing times have pushed the supply of new equipment out 4 to 12 weeks on sought after makes and models. The COVID-19 Pandemic is not the only source of this delay, however the rising price of steel and shipping costs are playing a part.

Tractor sales in October across the country were up 25%, with New South Wales highlighting a 70% increase on sales for the same period in 2019. Combine Harvester sales began to improve through October and Baler sales were up 21%. The upward trend continued in November, with a 38% increase in sales on the same period in 2019. New South Wales once again continued to be the best performer with sales up 84%, Victoria saw sales increase 13% and Queensland reported an increase of 55%, all in comparison to the same period in 2019. Baler sales in November were up 55% on the same period in 2019.

Tractor sales for 2020 have achieved levels not seen since the 1980s with over 13,000 units sold in a one month period. December sales increased 27% on the same period in 2019, and sales were up 24% overall on 2019 results. New South Wales continued to produce strong results with a 66% increase, Victoria had a 17% increase and Queensland was up 31% for December in comparison to the results in 2019. Smaller tractors under 40hp have performed the strongest with an increase of 36% on sales in the previous year, followed by the 40-100hp range that finished the year with a 27% increase on sale results in 2019.

Combine Harvesters finished the year off strong with a 25% increase in sales in comparison to 2019, and Baler sales finished 2020 with a 35% increase on 2019 results.

The Tractor and Machinery Association reported that demand from consumers in 2020 was for bigger horsepower machines with low emission engines.

The secondary Agricultural market throughout the fourth quarter has seen very limited numbers of assets presented at auction, however the secondary market for used machinery has remained strong and in demand.

With a lack of stock on the secondary market, buyers are willing to spend more to purchase agricultural equipment. This has been highlighted in the sale of a 2008 Fendt 411 Vario 4WD Tractor and Loader with 2,726 hours, selling for $90, 800 representing 100% of retail value and a 2005 John Deere 6420 4WD Tractor and Loder with 7,579 hours selling for $35,000 representing 77% of retail value.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2008 Fendt 411 Vario 4WD Tractor and Howard Quickie 455 Loader | 2,726 | $90,800 | 100% | VIC |

| 1996 Komatsu WA380 Wheel Loader | 14,036 | $65,280 | 100% | VIC |

| Same Dorado 85 Tractor | 1,333 | $18,000 | 90% | QLD |

| New Holland M160 4WD Tractor | $14,400 | 90% | QLD | |

| 2011 Iseki TG 5570 4WD Tractor | 603 | $27,000 | 90% | QLD |

| 2005 John Deere 6420 Tractor | 7,579 | $35,000 | 77% | VIC |

Automotive

Key Point Summary

- The automotive industry is grappling with stock shortages across the country;

- A total of 95,652 new motor vehicles were reported as sold for the month of December 2020;

- Toyota accounted for 22.3 per cent of all new cars sold in Australia last year;

- The auction market remains very strong across the country with dealers keen for secondhand stock and competing hard with end users to purchase secondhand vehicles; and

- SUV’s, Light Commercials and Dual Cab utes remain the most sought-after vehicles at auction.

New Automotive Market

Australian new-car sales surged in the last two months of 2020 as the nation came out of COVID-19 lockdowns – and the automotive industry is now grappling with stock shortages as a large proportion of buyers treated themselves to a new vehicle to holiday at home amid international travel restrictions.

Australian new-car sales surged in the last two months of 2020 as the nation came out of COVID-19 lockdowns – and the automotive industry is now grappling with stock shortages as a large proportion of buyers treated themselves to a new vehicle to holiday at home amid international travel restrictions.

A total of 95,652 new motor vehicles were reported as sold for the month of December 2020, an increase of 13.5 per cent compared to the same month the prior year. December 2020 delivered the second month in a row of growth (November 2020 was up by 12.4 per cent) after 31 months of decline, the longest market slump since the Global Financial Crisis of a decade ago.

The VFACTS data shows 916,968 new cars were reported as sold for the 2020 calendar year – down by 13.7 per cent compared to the prior year, but a recovery from the 48.5 per cent decline in April 2020, which was the sharpest slowdown since records were kept. The new-car sales result for 2020 was the lowest annual tally in 17 years – since 2003 – and the first time the Australian new-car market has dropped below 1 million since 2009.

Demand for utes, SUVs and four-wheel-drives surged as business buyers took advantage of the Federal Government’s instant asset write-off scheme and state governments fast-tracked infrastructure projects; sales to business fleets were down by just 4.7 per cent in December. Industry experts say the December 2020 figure could have been higher had many showrooms not run out of popular models such as utes, SUVs and four-wheel-drives.

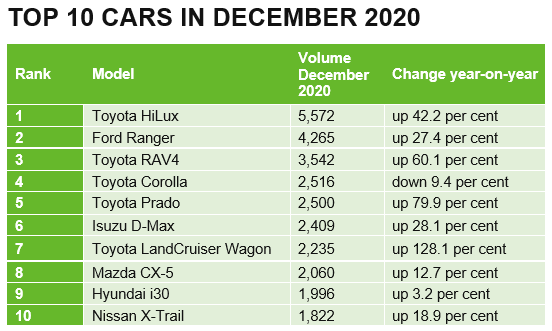

For the year and quarter, the best selling models followed the same path. The Toyota HiLux was Australia’s top-selling vehicle for the fifth year in a row, ahead of the Ford Ranger which ranked in second place for the fourth year in a row. The Toyota RAV4 was in third and Australia’s top-selling SUV for the first time (and biggest-selling hybrid), while the Toyota Corolla was fourth and the nation’s favourite passenger car for the eighth year in a row, ahead of the Hyundai i30 and Kia Cerato

Toyota accounted for 22.3 per cent of all new cars sold in Australia last year. It was Toyota’s second-highest market share result since its previous record set in 2008 (23.6 per cent). With Mazda in second, Hyundai in third and ford in fourth. While Holden had is last breath in fourteenth and with no cars sold in December.

Secondary Automotive Market

New car stock arrivals from overseas have been restricted again through Q4 and as a result stock levels within dealerships remain low, lead times on most dealerships are at least 3 months with some dealerships projecting an 8–12-month lead time. The auction market remains very strong across the country with dealers keen for secondhand stock and competing hard with end users to purchase secondhand vehicles. SUV’s, Light Commercials and Dual Cab utes remain the most sought-after vehicles at auction.

New car stock arrivals from overseas have been restricted again through Q4 and as a result stock levels within dealerships remain low, lead times on most dealerships are at least 3 months with some dealerships projecting an 8–12-month lead time. The auction market remains very strong across the country with dealers keen for secondhand stock and competing hard with end users to purchase secondhand vehicles. SUV’s, Light Commercials and Dual Cab utes remain the most sought-after vehicles at auction.

In Queensland we recently sold at auction a 2020 Toyota Landcruiser GXL Dual Cab Utility showing only 24 kms for $87,150, new price “on the road” is around $81,500. We also sold a 2018 Mitsubishi Triton GLS Dual Cab Ute showing 45,655 kms for $34,200. This vehicle was purchased new in 2019 for $38,000. Over a period of 18 months and 45,655 kms, the vehicle was sold at auction for only 10% under the original purchase price.

V8 Holden Commodores remain popular, with a 2016 Holden Commodore SS-V Redline showing 153,905 kms recently selling for $37,000, which represents around 95% of retail.

Victoria continued to see a strong interest in used car sales through auction from buyers across Australia, retail results have been achieved on several vehicles, a 2020 Land Rover Range Rover Sport SDV6 sold at auction for $114,300, 100% of retail the price, similarly a 2019 Land Rover Range Rover Sport SDV6 HSE sold for $128,500, 100% of the retail price.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2020 Toyota Landcruiser GXL Dual Cab Utility | 24 | $87,150 | 110% | QLD |

| 2017 Toyota Landcruiser Sahara | 72,579 | $94,500 | 102% | WA |

| 2017 Ford Ranger FX4 | 105,964 | $45,000 | 101% | WA |

| 2017 Toyota Hilux SR5 (4x4) | 56,534 | $44,500 | 100% | VIC |

| 2017 Ford Ranger Wildtrak 3.2 (4x4) | 153,061 | $40,300 | 100% | VIC |

| 2017 Toyota Hiace SLWB | 74,410 | $42,000 | 100% | VIC |

| 2019 Volkswagen Golf R | 18,436 | $45,520 | 100% | VIC |

| 2019 Land Rover Range Rover Sport SDV6 HSW | 17,197 | $128,500 | 100% | VIC |

| 2020 Land Rover Range Rover Sport SDV6 | 7,327 | $114,300 | 100% | VIC |

| 2014 Mercedes Benz CLS 63 AMG S | 60,811 | $94,000 | 100% | QLD |

| 2016 Range Rover Sport 3.0 TDV6 | 75,595 | $70,250 | 100% | QLD |

| 2016 Toyota Landcruiser Prado GXL | 61,686 | $46,700 | 100% | QLD |

| 2016 Ford Ranger XL 3.2 (4x4) | 160,980 | $27,500 | 100% | NSW |

| 2017 Toyota Hiace Van | 68,369 | $35,000 | 100% | NSW |

| Toyota Landcruiser GXL (4x4) 79 Series | 20,806 | $83,900 | 100% | NSW |

| 2016 Holden Commodore SS-V Redline | 153,905 | $37,000 | 95% | QLD |

| 2015 Audi Q7 3.0 TDI Quattro | 68,246 | $46,000 | 90% | QLD |

| 2017 Ford Mustang | 27,540 | $38,600 | 90% | QLD |

Specialised Assets

Over the fourth quarter, we saw many luxury goods presented at auction, including boats, campervans and motorhomes nationally with all assets performing strongly at auction. This is the result of the COVID-19 pandemic and Australian being unable to travel overseas for holidays, therefore have been purchasing luxury goods to enjoy their holidays at home.

November saw the sale of a fleet of Campervans across the country as highlighted in the above youtube video, made up of Toyota Troopcarriers, Toyota Hiaces and Toyota Hilux’s that were well advertised.

The highlighted sales from this auction was a 2018 Toyota Landcruiser Workmate (4×4) with 66,141 kms showing sold for $75,000 and achieved 88% of retail, 2018 Toyota Landcruiser Workmate(4×4) 2 Seat Troopcarrier with 119,455 kms showing sold for $66,100 and achieved 91% of retail and 2018 Toyota Hilux SR (4×4) Dual Cab with 104,178 kms showing sold for $57,300 and achieved 90% of retail.

Other luxury goods that performed well over the quarter include the sale of a Seaquester 530S Jetski Powered Boat with 2018 Sea Doo GTR-X Jet Ski that sold for $35,000 and achieved 100% of retail value and a 2008 Millennium 2400 Weekender with 198 hours showing sold for $29,601 and achieved 95% of retail value.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2013 Jayco Basestation Caravan | $53,100 | 115% | WA | |

| 2015 Jayco Flamingo | $22,322 | 100% | WA | |

| Seaquester 530S Jetski Powered Boat with 2018 Sea Doo GTR-X Jet Ski | 0 | $35,000 | 100% | QLD |

| 2008 Millennium 2400 Weekender | 198 | $29,601 | 95% | QLD |

| 2018 Toyota Landcruiser Workmate (4x4) | 119,455 | $66,100 | 91% | WA |

| 2018 Toyota Hilux SR (4x4) Dual Cab | 104,178 | $57,300 | 90% | WA |

| 2018 Toyota Hilux SR (4x4) Dual Cab | 117,069 | $57,100 | 90% | WA |

| 2018 Toyota Landcruiser Workmate (4x4) | 66,141 | 75,000 | 88% | VIC |

| 2018 Toyota Hiace LWB 4D Van | 62,935 | $54,650 | 87% | WA |

| 2018 Toyota Hiace LWB 4D Camper Van | 38,363 | $54,000 | 87% | VIC |