First Quarter Report for 2021

Across the first quarter of 2021, we continue to see strong growth across all equipment sectors in the market with both the new and secondary markets bouncing back from the effects of the COVID pandemic that occurred in the first and second quarters of 2020.

In the road transport sector, we have seen that new truck sales have commenced with a 7.9% increase in sales and the three segments (light, medium and heavy duty) recording growth throughout the quarter. The secondary market reflects the same trends in the new sector with auction results remaining strong across the country. The earthmoving and mining sector is showing us similar results to the road transport sector, with market leaders Caterpillar Inc announcing a 12% increase in sales and revenue in the first quarter.

In the road transport sector, we have seen that new truck sales have commenced with a 7.9% increase in sales and the three segments (light, medium and heavy duty) recording growth throughout the quarter. The secondary market reflects the same trends in the new sector with auction results remaining strong across the country. The earthmoving and mining sector is showing us similar results to the road transport sector, with market leaders Caterpillar Inc announcing a 12% increase in sales and revenue in the first quarter.

Agricultural equipment was the strongest performer for the quarter, with tractors sales being at record high levels, as shown in New South Wales who reported a 111% increase in sales in comparison to the same period in 2020, with this sector forecasting growth for the rest of 2021. The automotive market has seen a 13% increase in sales in the first three months of 2021 when comparing to sales results in the same period in 2020, with caution still being applied due to supply issues for new stock.

It is predicted that this growth will continue throughout the year, with the Federal Government announcing a $15.2 billion spend for infrastructure projects across the country over the next 10 years in the FY21/22 Budget.

$3.2 billion will go to projects in New South Wales, which will see a $2 billion upgrade to the Great Western Highway, between Katoomba and Lithgow. In Victoria, $3 billion has been allocated for projects including $2 billion for a Melbourne Freight Terminal and a $161.6m spend for an upgrade to the Truro bypass in South Australia.

Another major announcement in the FY21/22 Federal budget that will affect positive growth for the road transport, earthmoving, mining, agriculture and the automotive sector was the extension of the asset tax write scheme for another 12 months, throughout this report, we can see how this scheme has positively affected all segments over the last 6 to 12 months.

Ultimate Aussie Muscle Cars

Key Point Summary

Records are there to be broken and Ford smashed Holden!!

smashed Holden!!

Q1 saw one of our most popular classic car auctions ever. With the star being a 1971 Ford XY Falcon GT-HO Phase III which sold for $1.15 million making it the highest price ever paid for an Aussie built road car. Beating the $1.05 million paid in January for a Holden HSV GTSR W1 Maloo ute.

Our Ultimate Aussie Car Auction featured many more stars. The next highest price paid was $365,000 for a 2017 HSV GTSR W1 sedan (build number 206, priced at $160K when new) with just 50km on the clock, while a 2017 HSV Maloo GTSR ute sold for more than double its new price at $230,500.

Other classic Holdens sold included a 1977 Holden Torana A9X ($435,500), an unrestored 1971 HQ Monaro GTS for $171,500 and an LJ Torana GTR XU-1 for $210,500, while a Bathurst Edition E49 Valiant Charger nabbed $253,000 and a mint Nissan 260Z coupe fetched $116,000.

The record-breaking example of Ford’s most legendary Falcon GT wasn’t the only Aussie muscle car to attract attention at the Western Australia auction of vehicles formerly owned by failed Perth businessman Chris Marco, netting a total of more than $3 million.

Top Sales results:

1971 Ford XY Falcon GTHO – $1,150,000

1977 Holden LX Torana A9X – $435,000

2017 HSV GTSR W1 – $365,000

1971 Holden HQ Monaro GTS – $171,500

1972 VH Valiant Charger E49 – $253,000

1972 Holden LJ Torana GTR XU-1 – $233,000

2017 HSV Maloo GTSR – $230,500

1975 Datsun 260Z – $116,000

News Flash | Auction Result Grain Bulk Haulage

Slattery Auctions has completed a successful onsite sale of EJ & KR Brooks PL in Corowa NSW, a bulk haulage company specialising in the transport and storage of Grain, Stockfeed, Fertilizer and Hay. The sale generated $4.85m in sales, against an Auction Value of $3.64m for Receivers appointed.

The sale was a multi-vendor sale with assets for 3 of the big four banks, and a further 6 financers participating in the onsite sale. By offering assets in-situ from the business Corowa yard, hosting bidding via our online platform; the extensive local market in both the NSW and VIC agricultural surrounds could inspect assets across 4 days with ease and bid with confidence online. Bidding participation was national with trailers being sold into QLD, the Tractor into TAS and trucks across NSW/VIC.

The sale was a multi-vendor sale with assets for 3 of the big four banks, and a further 6 financers participating in the onsite sale. By offering assets in-situ from the business Corowa yard, hosting bidding via our online platform; the extensive local market in both the NSW and VIC agricultural surrounds could inspect assets across 4 days with ease and bid with confidence online. Bidding participation was national with trailers being sold into QLD, the Tractor into TAS and trucks across NSW/VIC.

The fleet comprised of late model Kenworth T610, T689, T909 Trucks, Sloanebuilt trailer sets, Grain Guzzler unit, Case 335 Tractor, and Agrison loaders. Whilst all assets exceeded Auction Values, standout results were the fleet of Kenworth T610 Tipper Trucks with Sloanebuilt tipper body and Quin dog trailers. These units exceeded new price with both 2020 and 2019 plated stockfeed units, exceeding $610-$620,000 under the hammer, 110-120% of retail price when new.

Sloanebuilt trailers across 2018 grain trailer, 2018 B-double grain trailer, and 2019 flat top b-double achieved 95% of new price; as lengthy wait times are quoted by trailer manufactures for new units, delivery times exceed the beginning of the pending 2021 harvest.

With another bumper crop expected this year and wait times for trucks and trailers, secondhand units are fetching premium prices, and in the case of late-model top tier examples in excess of new price.

Road Transport

Key Point Summary

- The new road transport market commenced the year strong with an overall 7.9% increase in sales

- The light duty truck market saw 42.9% growth in January 2021

- Japanese truck brands were the best performing brands for the quarter, with Isuzu, Hino & Fuso making up 53.3% of the entire market share in February.

- Lack of secondary trucks available on the market, with dealers and end-user battling it out to purchase units

New Road Transport Market

The new road transport market commenced the year strong with an overall 7.9% increase in sales over the same period in 2020.

The new road transport market commenced the year strong with an overall 7.9% increase in sales over the same period in 2020.

Across the three segments for January 2021, we can determine that the light duty truck market was the best performer for the month with a total of 729 new registrations, which equates to 42.9% growth in the market. This is followed by the heavy-duty market which saw growth of 1.5% with a total of 597 units registered, and the medium duty segment saw a decline of 15.9% on the same period in 2020.

February 2021 had a total of 2,769 units sold across all three segments, this in an increase from the 2,448 units sold in 2020 for the month, with the 805 units making up the heavy-duty segment, 494 units sold in the medium duty segment and once again the light duty segment achieved incredible results with 1,011 units sold for the month.

Throughout the first quarter, Japanese truck brands were the best performing brands with Isuzu taking the lead with the most units sold, followed closely by Hino and Fuso. Overall, the three brands made up 53.3% of the entire market share for February 2021, thanks to the big demand for medium and light-duty trucks to satiate the hunger for home delivery and distribution trucks.

The rise of new truck sales continued throughout March 2021, with all three segments recording growth for the month. The heavy-duty segment saw a total of 1,035 trucks sold for the month with an increase of 21.5% on March 2020 results, the medium duty segment sold a total of 602 trucks for the month and the three dominant Japanese brands – Isuzu, Hino & Fuso made up a total of 563 of the units. The light duty market continued to be the best performing segment for the quarter with a total of 1,231 units sold for the month of March.

Secondary Road Transport Market

The secondary road transport market throughout Australia has followed the same trends as the fourth quarter of 2020, with a lack of second-hand trucks available in the heavy duty, medium duty, and light duty sectors.

Dealers and end-users are continuing to jump at the opportunity to purchase what little stock is available to them.

This has been reflected at our monthly truck and machinery auctions, as highlighted in the sale of a fleet of well-maintained trucks and trailers in Tasmania, which saw a 2014 Isuzu FXY 1500 6×4 Tilt Slide selling to an end-user for $155,800 and a 2014 Volvo FM500 6×4 Prime Mover with 390,000kms selling for $119,700. Tippers have remained sought after in the Victorian market as highlighted in the sale of a 2010 Kenworth T388 6×4 Tipper with 453,006kms selling for $124,200 (100% of retail value) and a 2009 Volvo FM380 6×4 Tipper with 304,887kms selling for $88,250, both units were sold to a local dealer. In Queensland we saw the sale of a 2017 Mercedes Benz Actros 2658 Prime Mover with 269,176kms selling for $160,000 and a 140tonne rated 2006 Mack Superliner Prime Mover with over 1.1 million kms showing selling for $77,000, both these sales represent 90% of retail value, reflecting these strong results in the secondary market across the country.

In Queensland, older trucks have been performing well in the secondary market as shown in the sale of a 2015 Kenworth T909 with 931,378 kms showing selling for $145,000 and achieving 95% of retail value.

Medium and Light Commercial trucks in particular Isuzu’s, Fuso’s and Hino’s have been performing well across the country. These can be reflected in the results from our Sydney truck and machinery auction, that saw the sale of a 2009 Mitsubishi Fuso Canter 7/800 Pantech Truck with 185,000 kms showing that sold for $17,800 and achieved 95% of retail value.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2015 UD Nissan CK1938/CKB5E Removalist/Container Rigid Truck | 249,000 | $108,900 | 100% | NSW |

| 2010 UD UGW84D 60x4 Tipper | 92,300 | $92,300 | 100% | WA |

| 2013 Kenworth T609 Prime Mover | 654,814 | $159,000 | 100% | QLD |

| 2010 Kenworth T388 Tipper | 453,006 | $124,200 | 100% | VIC |

| 2014 Tuft Drop Deck Super Tilt Tray | $174,080 | 100% | VIC | |

| 2016 Hino 300 Series 2 Tipper Truck | 65,000 | $30,500 | 95% | NSW |

| 2016 Isuzu NLR150 Traypak Table Top Truck | 87,000 | $31,500 | 95% | NSW |

| 2009 Mitsubishi Canter 7/800 Pantech Truck | 185,000 | $17,800 | 95% | NSW |

| 2002 Krueger ST-3-38 Curtainsider A&B Trailer Set | $32,600 | 95% | NSW | |

| 2005 Isuzu FVZ1400 EWP | 165,195 | $72,600 | 95% | WA |

| 2008 International Eagle 9900I Prime Mover | 1,007,908 | $47,000 | 95% | QLD |

| 2018 Isuzu NQR 87/190 Tipper | 48,394 | $59,900 | 92% | VIC |

| 2014 Isuzu FXY1500 Sliding Tilt Tray | 357,380 | $155,800 | 92% | VIC |

| 2015 Mitsubishi FN600 Tilt Tray | 102,962 | $147,300 | 91% | VIC |

| 2012 Isuzu FS850 Long Crane Truck | 199,500 | $72,000 | 90% | NSW |

| 2009 Isuzu FSR850 Long Curtainsider | 414,000 | $44,800 | 90% | NSW |

| 2006 Mack Superliner (140 tonne rated) Prime Mover | 1,104,066 | $77,000 | 90% | QLD |

| 2017 Mercedes Benz Actross 2658 Prime Mover | 269,176 | $160,000 | 90% | QLD |

| 2012 Isuzu FH FVZ 1400 Tipper | 133,826 | $60,000 | 90% | QLD |

Earthmoving & Mining

Key Point Summary

- Caterpillar Inc. has reported a 12% increase in sales and revenue in the first quarter, with the construction industries in the Asia/Pacific seeing a 72% increase in sales

- Komatsu has reported there has been a steady recovery in the construction equipment sector for a second quarter in the row, highlighting positive growth

- The secondary equipment market has seen good quality and late model equipment sell well in the first quarter, due to the continued effects on supply chains from the COVID pandemic.

New Earthmoving & Mining Market

The new earthmoving equipment market commenced 2021 strong, with market leaders Caterpillar Inc, reporting a 12% increase in sales and revenue from the same period in 2020.

In the Asia/Pacific region, the construction industries saw a 72% increase, while the resource industries were down 1% and the energy and transport segment were down 9% on the same period in the previous year. The increase in the construction industry has been driven by higher sales across China and effects of the pandemic that hit the industry in the first quarter of 2020.

In comparison to the market leaders, Komatsu has reported demand for equipment in the first quarter has highlighted a steady recovery for the construction equipment sector for the second quarter in the row, this again reflects the effects that the pandemic had on the market in early 2020.

Secondary Earthmoving & Mining Market

In the secondary earthmoving market, good quality and late model equipment continued to sell well across the country. All states reported good results at the monthly Truck and Machinery auctions throughout the quarter. This is due to the continued effects on supply chains from the COVID-19 pandemic with suppliers for new equipment still seeing delays on delivery times for new units, consumers seeking to purchase equipment while the Government Stimulus package is still in play and the increased number of infrastructure projects that are currently underway across the country.

In the secondary earthmoving market, good quality and late model equipment continued to sell well across the country. All states reported good results at the monthly Truck and Machinery auctions throughout the quarter. This is due to the continued effects on supply chains from the COVID-19 pandemic with suppliers for new equipment still seeing delays on delivery times for new units, consumers seeking to purchase equipment while the Government Stimulus package is still in play and the increased number of infrastructure projects that are currently underway across the country.

Queensland has recorded the sale of a 2018 Yanmar ViO82 Hydraulic Excavator with 2,050 hours showing selling for $89,000, achieving a 100% of retail value and a 2019 Kubota SVL65-2 Tracked Skid Steer with 173 hours selling for $61,000, reaching 95% of retail value, highlighting the solid results achieved across the country. It has also been noted that the Queensland secondary market has seen good results for older, higher hour equipment sold at auction, this has been highlighted in the sale of a 2003 Caterpillar 966G Wheel Loader with 16,581 hours showing selling for $110,000, achieving 100% of retail value.

In Victoria, the good results and high enquiries for secondhand equipment continued, this was shown in the sale of a 2016 Bobcat S70 Skid Steer Loader with 1,494 hours selling for $18,00 and a 2018 CASE CX80C with 1,234 hours selling for $81,600. In Victoria, it has been reported that there has been an influx of enquiries for varying sizes of earthmoving equipment through the quarter, with sole traders searching for smaller machines specifically.

In Victoria, the good results and high enquiries for secondhand equipment continued, this was shown in the sale of a 2016 Bobcat S70 Skid Steer Loader with 1,494 hours selling for $18,00 and a 2018 CASE CX80C with 1,234 hours selling for $81,600. In Victoria, it has been reported that there has been an influx of enquiries for varying sizes of earthmoving equipment through the quarter, with sole traders searching for smaller machines specifically.

The New South Wales market during the quarter saw the sale of a 2019 Hitachi 22T Excavator and a 2015 Hitachi 13T Excavator achieving 94% of retail value at auction, indicating those good results throughout the country. It can be noted that smaller and medium sized earthmoving equipment was highly sought after throughout the quarter as showing in the sale of a 2012 Terex PT100G Skid Steer and a 2010 Sakai SW352-1 Smooth Drum Roller that sold for 100% & 98% of retail value.

Across the secondary mining equipment market there have been strong results for ex-mine light vehicles due to the low supply of new and used vehicles in the market. It has also been reported surplus underground mining equipment is forecast to be listed on the market in the upcoming quarters, with mining companies looking to dispose of surplus equipment.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2018 Yanmar ViO82 Hydraulic Excavator | 2,050 | $89,000 | 100% | QLD |

| 2013 Hitachi ZX55U-5A Hydraulic Excavator | 1,371 | $80,000 | 100% | QLD |

| 2012 JCB 3CX Backhoe Loader | 5,115 | $61,000 | 100% | QLD |

| 2003 Caterpillar 966G Wheel Loader | 16,581 | $110,100 | 100% | QLD |

| 2010 Volvo EC380 Excavator | 10,455 | $100,000 | 98% | WA |

| 2019 Kubota SVL65-2 Tracked Skid Steer Loader | 173 | $61,000 | 95% | QLD |

| 2016 Kobelco SK17SR-5 Mini Excavator | 829 | $20,000 | 95% | NSW |

| 2018 Case CX80C Excavator | 1,234 | $81,600 | 89% | VIC |

Agriculture

Key Point Summary

- Demand for agricultural equipment is expected to rise throughout 2021

- Tractor sales in January were up 60% on the same period last year, with NSW reporting a 111% increase on the same period last year

- Out-Front Mowers saw an increase of 124% in January 2021, in comparison to January 2020

- The secondary market has remained strong, with very little stock available on the market

The Australian agricultural market has remained strong throughout the first quarter of 2021, with good seasonal condition across the country. Highlighting these conditions is the winter crop production in Western Australia which has estimated to reach of 16.8 million tonnes in 2020-21, this is an increase of 18% on the 10 year average.

Demand for agricultural equipment is expected to rise throughout 2021, with this being highlighted in the sale of the new equipment sales throughout the first quarter. Tractor sales in January were up overall by 60% on the same month in 2020, with New South Wales having an incredible 111% increase on January 2020 sales. Followed by Queensland who was up 63%, Tasmania up 68%, Western Australia up 47%, Victoria up 30% and South Australia was up 24%. Breaking this down by segment, we can see that there has been an 81% increase for under 40hp range, 56% increase for tractors between 40 to 100hp range, 42% increase for tractors 100 to 200hp and a 73% increase for tractors in the 200 hp plus range. Baler sales remained stable in January 2021 with similar sale results achieved in December 2020 and Out-Front Mowers are still achieving great results with an increase of 124% on the same period in 2020.

Demand for agricultural equipment is expected to rise throughout 2021, with this being highlighted in the sale of the new equipment sales throughout the first quarter. Tractor sales in January were up overall by 60% on the same month in 2020, with New South Wales having an incredible 111% increase on January 2020 sales. Followed by Queensland who was up 63%, Tasmania up 68%, Western Australia up 47%, Victoria up 30% and South Australia was up 24%. Breaking this down by segment, we can see that there has been an 81% increase for under 40hp range, 56% increase for tractors between 40 to 100hp range, 42% increase for tractors 100 to 200hp and a 73% increase for tractors in the 200 hp plus range. Baler sales remained stable in January 2021 with similar sale results achieved in December 2020 and Out-Front Mowers are still achieving great results with an increase of 124% on the same period in 2020.

February 2021 continued to see strong results, with an overall increase of 74% in tractor sales for the same period in 2020. With the continued increase in sales since mid-2020, we can see how determinant the effects of the drought, bushfires and the early stages of COVID-19 impacted the agricultural equipment market in late 2019/early 2020, as sales level continue to bounce back stronger. Baler sales in February were up 55% on the same month as past year, and Out-Front Mowers had a 51% increase.

February 2021 continued to see strong results, with an overall increase of 74% in tractor sales for the same period in 2020. With the continued increase in sales since mid-2020, we can see how determinant the effects of the drought, bushfires and the early stages of COVID-19 impacted the agricultural equipment market in late 2019/early 2020, as sales level continue to bounce back stronger. Baler sales in February were up 55% on the same month as past year, and Out-Front Mowers had a 51% increase.

Tractor sales for March remained strong with a 64% increase in comparison to the same month in 2020. The 200hp plus range tractors saw the highest increase in sales, with a 72% increase pushing the segment along 92% year to date. New South Wales continued to be the best-performing state with a 98% increase in sales in comparison to March 2020, followed by Queensland up 64% and Victoria up 47%.

The secondary equipment market remains strong, with very little stock available on the market. The highlight for this quarter was a 2015 Fimaks FMGR180 Spreader that sold for $28,200 and achieved 89% of retail value.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2008 John Deere 5525 Tractor | 6,281 | $38,850 | 95% | QLD |

| Valtar N111E 4WD Tractor | 8,041 | $30,000 | 90% | QLD |

| 2011 Miller N2XP Self Propelled Spray Unit | 2,500 | $105,000 | 90% | QLD |

| John Shearer Econo 35 Tyne Draught Plough | $11,000 | 90% | QLD | |

| 2015 Fimaks FMGR180 Spreader | $28,200 | 79% | VIC | |

Automotive

Key Point Summary

- There has been a 13% increase in new car sales for the first quarter in comparison to the same period in 2020

- Supply issues for cars continued to cause an impact in the new car sales market

- Electric vehicle sales reach a total of 411 for March 2021

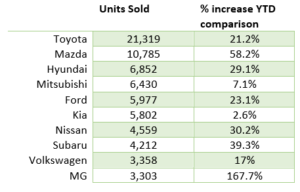

- Toyota continues to be the leading car brand with a total of 21,319 sales for March 2021

- The secondary market has remained strong in the first quarter.

New Automotive Market

Australia’s new-car market has the potential to return to one-million-plus sales in 2021 after the Covid-19 pandemic made 2020 the first year to miss the magic million mark since 2009.

March was the first March to pass 100,000 sales since 2018 – a monthly result that, historically, has always concluded with the market going on to 1,000,000 units.

The second is that 2021’s first quarter total of 263,538 equates to a 13 per cent increase compared with the first three months of 2020. If that growth is maintained, the market will nudge over one-million units by about 8600 vehicles.

It’s also worth noting that 2021 has achieved this result despite the absence of Holden, which even this time last year had contributed 9000 sales.

However, there are also reasons to be cautious. This year’s Q1 total is the lowest since 260,122 vehicles were registered in the first three months of 2012. And it’s nearly 30,000 vehicles short of the Q1 total in the record 2018.

Supply issues – notably the global computer chip shortage – prevented March 2021 from reaching its full potential and could take months or longer to be resolved. And, of course, future state lockdowns can’t ever be ruled out in the era of a pandemic.

The next few months will reveal more clues, but for now let’s take a look at the models and brands leading the way in the sales races.

Sales of electric vehicles reached 411 in March, an increase of 248 compared with the same month in 2020.

March followed the quarter with Toyota as the leading brand with sales of 21,319 vehicles (21.3 per cent of the market), followed by Mazda with 10,785 (10.8 per cent), Hyundai with 6,852 (6.9 per cent), Mitsubishi with 6,430 (6.4 per cent) and Ford with 5,977 (6.0 per cent).

MG’s remarkable rise from obscurity to popularity continues, with 163 per cent year-on-year growth putting it on 8728 sales and the fringes of the top 10. This has been achieved with just three models.

MG isn’t the only Chinese success story. GWM/Haval and LDV are both up 118 per cent.

MG isn’t the only Chinese success story. GWM/Haval and LDV are both up 118 per cent.

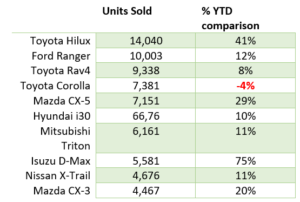

The Toyota Hilux was the best-selling vehicle in Q1 with sales of 14,040 vehicles, followed by the Ford Ranger (10,003), the Toyota RAV4 (9,338), the Toyota Corolla (7,318,) and the Mazda CX-5 (7,151).

Secondary Automotive Market

Q1 continued to see strong buyer participation in used car sales through auction from buyers across Australia. Retail results have been achieved on several vehicles, a 2016 Ford Territory sold at auction for $35,100, 100% of the retail price, similarly a 2018 Ford Everest sold for $56,750, 96% of the retail price.

Q1 continued to see strong buyer participation in used car sales through auction from buyers across Australia. Retail results have been achieved on several vehicles, a 2016 Ford Territory sold at auction for $35,100, 100% of the retail price, similarly a 2018 Ford Everest sold for $56,750, 96% of the retail price.

New car stock arrivals from overseas have been restricted again throughout Q1 and as a result stock levels within dealerships remain low. Lead times with most dealerships are at least 3 months with some dealerships projecting an 8-12 month lead time.

Wholesale buyers are reporting a major shortage of vehicles to purchase across the country. In Victoria throughout Q1, 212 cars have been presented to auction with 193 selling, resulting in a 91% clearance rate. Late in Q1, results appeared to soften, with clearance rates dropping to 81%. The imminent end to the Government JobKeeper Payment Scheme on March 28th may have been a contributing factor.

Commercial vehicles are still fetching good prices with Hilux, Ranger, Colorado and Vans being the models of choice, but we are now seeing noticeable drops in pricing compared to February.

In mid-February we sold a 2016 Ford Ranger XL Crew cab with just over 100,000kms for $33,200. It was valued at $27,000 which would normally be generous (Glasses guide suggested it was $22,000 at auction and $27,200 at retail)

A month later in Mid-March we sold virtually the same vehicle (just under 100,000kms) for $29250 and it was valued at $28,000, a noticeable drop in the market. (Glasses guide being the same pricing as above) Both of these vehicles coming from the same vendor.

| Assets | Kms/Hours | Price Achieved | % of retail | State |

|---|---|---|---|---|

| 2015 HSV Clubsport R8 Wagon | 52,856 | $82,150 | 105% | QLD |

| 2018 Toyota Landcruiser Prado | 26,430 | $68,100 | 103% | WA |

| 2018 Mitsubishi Outlander | 45,000 | $25,100 | 100% | WA |

| 2017 HSV Maloo R8 LSA Utility | 31,938 | $131,000 | 100% | QLD |

| 2019 Ford Ranger Wildtrack | 54,709 | $52,250 | 100% | QLD |

| 2015 Infiniti QX80 S Premium | 67,929 | $51,609 | 100% | QLD |

| 2014 Ford Ranger XL | 210,000 | $16,400 | 100% | NSW |

| 2016 Ford Territory | 59,346 | $35,100 | 100% | VIC |

| 2018 Porsche Cayenne | 21,020 | $126,100 | 99% | WA |

| 2018 Nissan Navara ST (4x4) | 49,926 | $42,800 | 98% | VIC |

| 2018 Ford Everest | 37,585 | $56,750 | 96% | VIC |

| 2016 Maserati GranCabrio 10 4.7L 6SPA V8 Convertible | 7,094 | $160,000 | 95% | QLD |

| 2019 Toyota Rav4 | 7,561 | $38,800 | 94% | VIC |

| 2020 Toyota Hilux Cab Chassis | 29,000 | $24,000 | 92% | NSW |

| 2015 Toyota Landcruiser Prado GXL | 83,097 | $47,950 | 92% | VIC |

| 2018 Renault Megane RS 280 | 34,483 | $37,500 | 90% | QLD |

| 2018 Hyundai i30 GO | 37,000 | $17,100 | 90% | NSW |

Aviation

Aviation passenger numbers have continued to increase over the Q1, with the easing of boarder restrictions to all states and territories for the first time since the pandemic began. However, passenger numbers are continually impacted by the snap lockdowns that have occurred throughout the country in recent months.

The federal government has recently provided the tourism industry a significant boost through subsidized flights throughout regional Australia. This has had a significant uplift in passenger numbers on domestic routes and will continue to provide more certainty in this market.

The federal government has recently provided the tourism industry a significant boost through subsidized flights throughout regional Australia. This has had a significant uplift in passenger numbers on domestic routes and will continue to provide more certainty in this market.

Reginal Express Airlines (REX) has entered the lucrative Sydney – Melbourne domestic market with the launch of daily flights using a Boeing 737 aircraft. With REX’s entrance to this market, QANTAS has taken the opportunity to fly several regional routes in direct competition with REX.

Slattery Asset Advisory

Slattery Asset Advisory’s aim is to be the most innovative and bespoke Valuation and Advisory Service in Australia and is on the cutting edge of valuations and reports. With this Step Ahead of the curve, we have aligned ourselves with Industry Best Practice and Standards.

Both International and Australasian Governing bodies such as the IVSC and API are considered the pinnacle of valuations and they are constantly reviewing and updating their guidelines and views relating to Valuations and the Industry Best Practice and Standards.

Slattery Asset Advisory has taken up this Industry Best Practice and have changed what many of us know and refer to as Desktop Valuations, and that have now been addressed as ‘Restricted Assessments’. We adopted this change, and you will see this on our “sight unseen” reports.

Slattery Asset Advisory is available to assist with ensuring your asset registers are up to date and depreciation schedules are ready for tax time and we can assist in creating a user-friendly report that accountants, CFOs and the likes can use easily. We provide many services including valuing your assets for Insurance Purposes, Due Diligence, Financial Lending; we can even assist with Auction and Marketing services.

If you do have any valuation needs, please contact our Valuations Co-ordinator on 02 4028 0008 or at [email protected]